Inventory Accounting: Best Practices for Businesses

Managing inventory is more than tracking what’s on the shelves—it’s about protecting profit, preventing loss, and making smarter operational decisions. For startups and growing businesses, working with a reliable accounting and bookkeeping service for startups ensures your inventory methods are accurate, scalable, and audit-ready.

At Ceptrum, we help businesses establish inventory controls that support financial transparency and long-term success.

Why Inventory Accounting Matters

Poor inventory management can lead to:

- Inaccurate financial reporting

- Over or understocking

- Missed tax deductions

- Lost revenue and wasted resources

That’s why integrating solid accounting practices from the beginning is key to keeping your business agile and profitable.

Best Practices for Inventory Accounting

1. Choose the Right Valuation Method

Different valuation methods impact profit and taxes:

- FIFO (First In, First Out): Common in food or retail; reflects rising costs over time.

- LIFO (Last In, First Out): Useful in inflation-heavy industries (note: not allowed under IFRS).

- Weighted Average Cost: Smooths out price fluctuations over time.

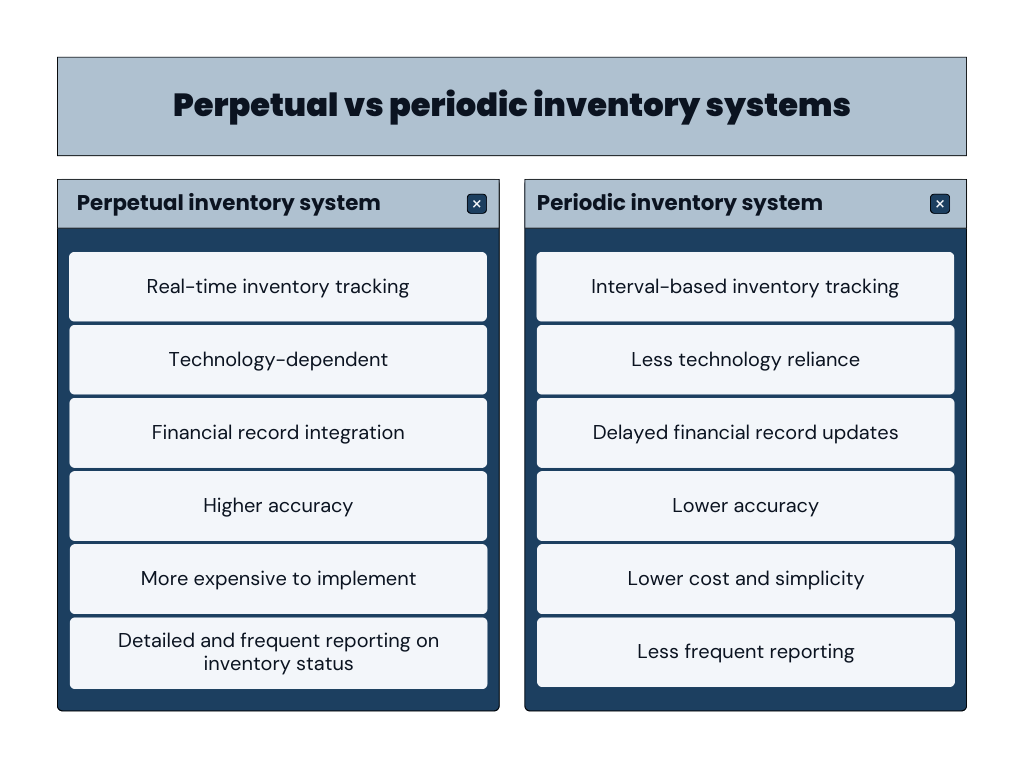

2. Implement Periodic or Perpetual Systems

- Periodic: Inventory is updated at set intervals. Suitable for small stock or low frequency sales.

- Perpetual: Real-time updates with each transaction. Ideal for e-commerce or high-volume businesses.

We offer cloud integrations to simplify both approaches and reduce manual error.

3. Conduct Regular Stock Audits

Physical stock counts help detect shrinkage, theft, or misplacement. Combine manual counts with your digital system to validate accuracy.

Pro tip: Schedule monthly spot checks in high-turnover areas.

4. Track Cost of Goods Sold (COGS)

![]()

COGS directly affects profit margins. Accurately reporting it requires:

- Clean purchase records

- Timely updates to inventory balances

- Alignment with your valuation method

Ceptrum automates COGS tracking with scalable accounting tools.

5. Leverage Automation for Smarter Insights

Inventory automation tools can:

- Alert for reorder points

- Track aging inventory

- Sync with sales platforms

We help integrate these tools into your financial system for real-time inventory intelligence.

Ceptrum helps startups choose and implement the best-fit method based on industry and goals.

FAQs

1. Can I manage inventory with spreadsheets?

Yes, early on—but as you grow, spreadsheets can become error-prone. Tools recommended by Ceptrum offer automation, accuracy, and scalability.

2. What if my physical stock doesn’t match my books?

This is common. Conduct a stock audit and investigate discrepancies. Our team helps you reconcile records without disrupting operations.

3. Do I need to record inventory even if I don’t manufacture products?

Absolutely. Whether you buy or make goods, tracking inventory ensures accurate profit reporting and tax deductions.

4. How often should I update my inventory valuation?

Ideally after every transaction (perpetual). At minimum, update monthly or quarterly for reporting accuracy.

5. Is inventory deductible for tax purposes?

Not directly. Inventory affects COGS, which in turn reduces taxable income. Proper accounting ensures all eligible deductions are captured.